How Eqvista helps to manage shares & shareholders for your Hong Kong company?

Ever wonder how to effectively track and manage the shares of your Hong Kong company? A critical part of being a founder is managing the ownership in the company, be it with the founders, employees or new investors. Obviously, you do not want to lose control over the company by giving out all the ownership shares. So, it is essential to keep track of all the shares and the shareholders in a company.

This article will help you understand how Eqvista can help with shareholder management in your Hong Kong company.

Hong Kong Company Shares

When a company is incorporated with the government, the company becomes separate from the person incorporating it. And for a person to own the company, they would have to own a part of the company’s shares. By owning shares in a company, the person becomes a company shareholder and receives some benefits and responsibilities along with the ownership.

There are different types of companies and different kinds of shares issued as well. Both of these decide what kinds of benefits and rights the shareholder will get.

Types of Hong Kong companies

Although there are many different types of Hong Kong companies, when talking about the companies that offer shares to their owners, there is one main kind, the limited company. The LLC (Limited Liability Companies) in Hong Kong fall into three categories, namely public, private, and limited by guarantee. Each has been explained below to help you understand them better:

Private limited companies limited by shares

This kind of business is usually chosen by small and medium (SMEs) to conduct business and trade. This type of company requires just one shareholder, a registered office, a Hong Kong local secretary, and one natural director. This company can have a maximum of 50 shareholders.

The liability of the company’s members is limited to the amount of shares held by each shareholder. There is no requirement for minimum share capital. And the shares can be transferred but are subject to the company’s refusal to register the transfer of shares. The company shareholders get the profits of the company based on the number of shares they own in the company.

Public limited companies limited by shares

Large corporations usually choose a public limited company by shares to conduct business and trade. The company’s structure requires a registered office, a Hong Kong local secretary, one member, and two directors. Corporate directors are not allowed, and the company should have more than 50 shareholders in it.

The liability of its members is limited to the amount of shares held by each shareholder. In this structure, there is no minimum share capital requirement. And the shares in this company can be traded easily and freely, and may or may not be listed on the Hong Kong Stock Exchange. All the profits would be distributed to its shareholders.

Companies limited by guarantee

The company limited by guarantee is usually preferred by charities, non-profit organizations, clubs, or societies to raise funds for humanitarian purposes. Only two directors, a registered office, a Hong Kong local secretary, and one member are needed. The company can have more than 50 shareholders, and no corporate directors are allowed in this company structure.

There is no share capital in the company limited by guarantee. And the liability of the company members is limited to the amount agreed to contribute in the event of the company’s liquidation. The profits in this kind of company cannot be distributed among the members.

Types of shares issued by Hong Kong companies

A share is a unit of ownership in a company and comes with some benefits and responsibilities. Although there are some basic kinds of shares that companies use, the company also has the right to alter the benefits and responsibilities that come with a share. Just so you know, there are two main kinds of shares that are offered in Hong Kong companies. These include:

- Ordinary shares – These are the most common kind of shares issued by a company and a lot of the companies just issue ordinary shares. This share gives one vote per share to the owner and offers equal rights in receiving dividends and distributions of the company’s capital when dissolved.

- Preference shares – Preference shares come with a favored right to return of capital and dividends. This means that the preference shareholders would get the dividends before the ordinary shareholders. But these shares do not have the same voting rights. They are usually non-voting shares and can at times be redeemable. Due to its many benefits, this kind of share is often given to the investors in a company.

Transfer of shares in a Hong Kong company

There are two ways by which shares are transferred within a company. First, when the new shares are issued to a person from the company. And the second is when a shareholder of the company wants to transfer (sell or gift) their shares to another person. Both ways have been explained below:

Process of transferring shares in a Hong Kong company

Let us say that you are a shareholder in the company and want to transfer your shares to someone else. You will have to ensure that the pre-conditions for your rights are waived or satisfied. Before you can transfer the shares to a new shareholder, you will have to offer them to the company’s existing shareholders first, as per the provision rights stated in the company’s Articles of Association.

The next step is to prepare the following documents:

- Latest audit report within six months; and/or Certified management accounts within three months

- Resolutions

- Sales & purchase agreement (optional)

- Instrument of transfer

- Contract notes (bought and sold note)

After this, send the documents to have them pre-approved by the Board of directors. Then, prepare the transfer form and the sale agreement form by getting the signature of both the seller (transferor) and the buyer (transferee). After that, these documents need to be stamped by the authorities, and the stamp duty paid for:

- Stamp duty for each instrument of transfer has a fee of HKD 5.00

- Stamp duty is 0.2% of the total value of the shares about to be transferred or the consideration, whichever is higher.

Once the documents are stamped, the transfer would be completed.

Process of Issuing new shares in a Hong Kong company

The issuance of new shares in a Hong Kong company occurs when the directors allot the shares after the company has been created. The distributions of the shares, beside the allotments, offered to the company’s existing shareholders, can be done after the shareholders’ approval before this in a general meeting. This approval might be delivered either with a particular allotment or any allotment in general.

For this process to be complete, the return of allotment of shares and the shareholders getting it has to be noted and submitted to the Companies Registry within a month before the assignment’s date. In case you do not meet the time limit, the Registrar can refuse to approve the return of the allotments for the filing of the Change of the Company Shareholders in Hong Kong. Moreover, you also need to submit to the court for leave to file the return after the time has passed.

Contact Startupr for our services in transferring or issuing new shares.

Documents required

When you are about to issue or transfer shares in a Hong Kong company, you will need to submit some documents as well:

- The copy of the Articles of Association of the Company;

- Subsidiary’s audit report and/or certified latest management accounts (if any);

- Sale & Purchase Agreement (if any);

- Land property information (if any);

- Resolution of distribution of dividend (if any);

- The number of shares to be transferred;

- Name of the seller (Transferor);

- A copy of the residential address, passport, or identity card of the new shareholder (transferee); and

Hong Kong Company Shareholders

Shareholding in a company is the expression of the shareholders’ legal power, and that varies in proportion to the shares held respectively. A person becomes a shareholder in the company when they get a Hong Kong company share certificate.

Just as a shareholder gets a return on investment from the company, they also get a set of rights. These rights usually vary based on the kind of shares the shareholder holds. The rights of the shares are usually noted in the Articles of Association of the company.

So, what are the rights of shareholders of a Hong Kong company?

All the specific rights of each kind of shareholder are normally included in the Articles of Association. Here are some of the main rights in the Articles:

- A shareholder is entitled to get a dividend from the company when profits are available.

- When the company is winding-up, the company’s shareholders are entitled to the company’s surplus assets after all the debt has been paid.

- Different shares might have rights to vote under specific circumstances, where the company has different classes of shares. Normally, each share comes with one vote for general meetings. But there are shares that are non-voting or shares that have multiple votes.

How Eqvista helps in managing shares and shareholders?

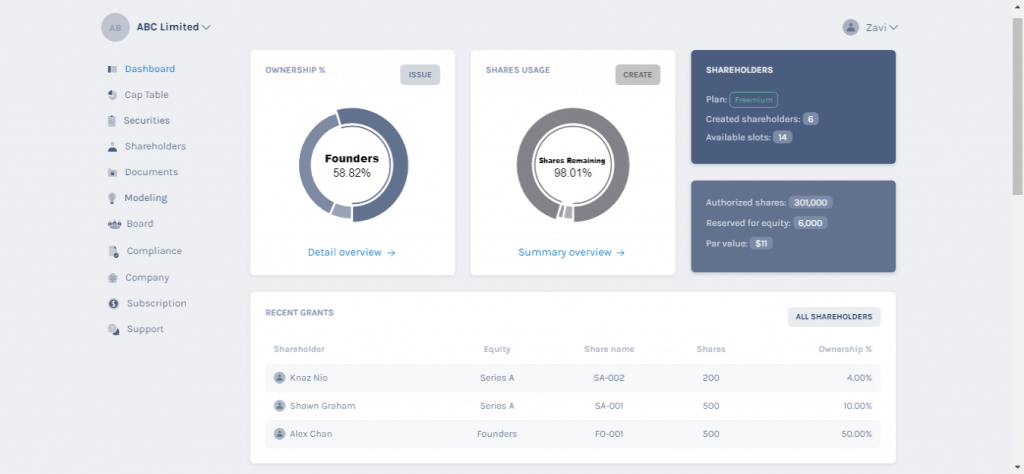

With this said, you always need to keep track of and manage the shares of your Hong Kong company. In fact, if you do not manage the shares of your company properly, it would lead to costly mistakes for your company. That is where Eqvista comes into play. Eqvista is an advanced cap table application that enables you to take care of your company’s shares. You can easily use this application for shareholder management of your Hong Kong company.

Eqvista allows you to share access to the company’s shares with your founders, shareholders, or employees. Issue share certificates and manage all your shareholdings all in one place. They also have a knowledge-based center that would help you be a great founder and manage your shares. Check out the app here.