What is a Business Registration Number and Why do you need one in Hong Kong?

While registering a company in Hong Kong, there are many processes and documents that need to be taken care of. You’ll need to register your business to the Companies Registry, as well as the Business Registration Office before you conduct any business in Hong Kong. From here, you will receive your Company Registration Number (CRN) and Business Registration Number (BRN). These two numbers are important for any business since they are used on every legal business document, including when filing the tax returns, signing a contract, renting an office space, or even when opening a bank account. In this article, we discuss the importance of having a business registration number, benefits of a BRN, and how to register your business in Hong Kong.

Business registration number in Hong Kong

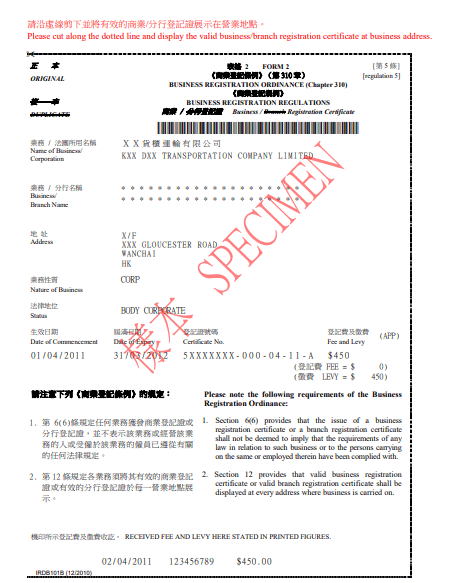

The registration of a Hong Kong company is done with the Business Registration Office, which is a part of the Inland Revenue Department (IRD). Once you register your business, you get a business registration certificate (BRC), which is a document that details everything about a company. Having a PRC is similar to having a permission slip; it allows you to conduct business activities in Hong Kong.

A BRC has the following information on it:

- Name of the business

- Nature of the business

- Type of business

- Address of the business

- Date of business commencement

- Certificate number (which is the Business Registration Number)

- Expiry date

What is a Business registration number (BRN)?

A business registration number or BRN is an 8-digit sequence number that each business gets when they register their business in Hong Kong. It is important for each business to get a BRN before their work location is set up and before they can begin their business operations. Issuing this number from the IRD is quite simple and can be easily done online. Once the BRN has been issued online, owners can cross-check its status at any time to ensure that it is being issued correctly. Moreover, anyone in public can easily look for your company’s BRN or company information using the BRN online through the eTax service on the IRD website.

Business registration number(BRN) sample format

As shared above, a BRN is an 8-digit number that can be found on the business registration certificate. It is the first 8 digits of the business registration certificate number. This number can be found at the bottom of the certificate under the heading certificate no.

What businesses require a business registration number (BRN)?

In Hong Kong, any business that is about to conduct or is conducting business activities requires a BRN. This is a requirement under the Business Registration Ordinance (BRO). With this said, here is a list of businesses that need a business registration number before they can operate in Hong Kong:

- Any activity performed to create profits needs a BRN. Examples include craftsmanship, professional services providers, and commerce retail enterprises.

- Business activities of a company that do not require a BRN include charity work that has been approved by a charity institution, fishing, rearing and breeding livestock, market gardening, and agriculture.

- Clubs that offer services and facilities to their members for a fee, which is considered a profit for the business.

- Every company that has been incorporated in Hong Kong, including those that conduct business in Hong Kong and other jurisdictions.

Overseas companies that are in Hong Kong will also have to register with the IRD if they:

- Rent out their Hong Kong property.

- Have a liaison office or representative in Hong Kong.

- Have an established place of business in Hong Kong, even if the company does not do any business in the region.

The companies that do not need a BRN are the ones that do not earn profits or are idle. Moreover, if you are an individual who is employed in a large organisation in Hong Kong, you do not need a BRC.

Key differences between BRN and CRN

Just like registering a company and registering a business in Hong Kong are different, there is also a huge difference between a company registration number (CRN) and a business registration number (BRN). Let us understand what a CRN is first.

A CRN is like the social security number of a company. It is a form of identification (ID) for your company. Just like the BRN, the CRN is a very important requirement for every incorporated company since it represents your company on legal documents and government records. The CRN can be found in the top left corner of the Certificate of Incorporation.

With this clear, here is a table explaining the difference between a company registration number and a business registration number in Hong Kong:

| CRN | BRN |

|---|---|

| CRN is a SEVEN-digit number that the Companies Registry issues in Hong Kong. | BRN is an EIGHT-digit number that is issued by the Inland Revenue Department (IRD) in Hong Kong. |

| CRN acts as the social security number of a company and is used as a form of identification for a company in Hong Kong. | BRN acts as the Tax identification number of a business and is used for legal tax-related matters, including the filing of tax returns. |

| CRN can be found on the top-left corner of the Certificate of Incorporation. | BRN can be found on the bottom of the business registration certificate under the heading “certificate no”. |

| CRN is required only for companies incorporated in Hong Kong, such as an LLC or a foreign company. Sole proprietorships and general partnerships do not need a CRN. | BRN is required by every kind of business except those holding an office or employment but is not conducting any business. |

| CRNs expire after a period of time and have to be renewed again. | BRNs do not expire until and unless the company ceases to exist. |

Benefits of having a Business registration number (BRN) in Hong Kong

As mentioned earlier as well, a BRN is a unique ID number provided by the IRD and is actually considered the company’s TIN – tax identification number. This number is very important, especially used by you when dealing with different government agencies. One main use of the BRN is when you are filing for your company’s annual tax returns. In short, the BRN is used for tax payments and other legal business operations in Hong Kong.

Penalties of not having a BRN and Other Risks

Not having a BRN is considered an offence that can result in jail terms and/or hefty fines from the government. Furthermore, if you apply for the BRN after a year or so of starting your business activities, you will have to clear all the fees and penalties before getting the BRN.

In fact, you should not just be afraid of the penalties. Without a BRN, you cannot file your business tax returns. This can cause a huge issue with the IRD. And the IRD can sue your company or impose fines for the same, which will just bring you further down. Moreover, without a BRN, you might not be able to conduct business properly as well since traders would want to see the business registration certificate before they work with you. So, the best way out of this is to get a BRN on time and be prepared so your business operations can run smoothly.

How to get a Business registration number (BRN) in Hong Kong?

There are two ways to get a business registration number in Hong Kong; online or in person. The online applications must be filed via the eTax portal of the IRD website. Businesses must fill out the form and pay the fee through this portal. It should be noted that only the sole proprietorship and partnership business types are the only ones that can apply for a BRN using the eTax portal.

The second method is by going to the Business Registration Office of the IRD and submitting the application in person. If you’re not familiar with the process, it is always better to hire a professional service like Startupr to help you. In fact, to register your business, you will need a company secretary, who is also in charge of handling these things. This is where Startupr can help you; by being your company secretary and handling all the legal processes for your business.

With this said, you need to prepare the following documents and things that will be submitted to the BRO to obtain the BRN:

#1 Local Companies:

- Incorporation Form – which is the form NNC1 or form NNC1G, depending on the type of company

- Notice to Business Registration Office using the form IRBR1

- Articles of Association, if applicable

- Fees

#2 Non-Hong Kong Companies:

- Application Form NN1, plus required documents as per the form (will be mentioned on it)

- Notice to Business Registration Office using the form IRBR2

- Fees

Once you have submitted the application to the BRO, it will take a few days to be processed. The agency will send an email notification to you on your business registered email address and contact number once it has been processed. You will receive the business registration number in Hong Kong in the notification, and the certificate will be mailed to your registered address accordingly.

How to check the Business registration number (BRN)?

Check your BRN or the BRN of any business using the eTax portal on the IRD website. When you visit the website, go to the Business Registration Number Enquiry and Application for Supply of Information under the Business Register section. From here, there are six actions that you need to take while filling out your business details along the way.

The CTAs or actions you will have to take to check the BRN are listed in the sequence below:

- Click on Enquire Now.

- Click on Begin Application.

- Read the Personal Information Collection Statements & NB notes, scroll to the bottom, and click on Agree.

- This takes you to the Step 2 screen. Select Conduct Business Registration Enquiry under the services menu and click on Continue.

- This will take you to Step 3. Fill in the business details and then click on Application for supply of information. You can also click on New Search to start the process all over again.

The results will display the business registration number of the said business in English or Chinese. Also, it should be noted that you will have to type in the full English or Chinese name of the business along with its location to get the search results.

Does any change in business affect the Business registration number (BRN)?

It is obvious that from time to time, a company changes in many ways that will help it grow and become better. Even though these changes are great, when any change is made to the nature of the business, address, or name of the business, the company will have to notify the Business Registration Office (BRO) regarding the change. These changes are updated in the BRO database and are a very important step. To explain better, let us say that a company changes its name and forgets to notify the BRO about it. In this case, when the company is filing for the tax return, its new name will be used, and it will cause issues with the IRD department. All this can lead to hefty fines and even lawsuits. Hence, it is important to notify the BRO about any changes made in the company.

Moreover, the company owners will also have to notify the BRO if the company is about to cease to exist. This needs to be done at least one month before any business activity cessation occurs. With this notification, the BRO will authorise the request, and once it has been authorized, the company will no longer be registered. The BRN will also be cancelled and will no longer be valid. In this case, the company cannot just get back to doing business after it. The owners will have to register the company all over again before they can do business.

Get professional assistance to register your company in Hong Kong with Startupr!

For you to be able to conduct any business in Hong Kong, you will need to get the business registration number. The BRN can be applied online from the IRD website. Once you have applied for it or received it, you can check its status or details on the eTax service on the website. Kindly note that the BRN acts as your tax identification number, which is important. So, if you have decided to start a business in Hong Kong, do not forget to apply for your business registration certificate as well. In fact, Startupr can help you with this. We offer company registration and company secretarial services. Our team works on every legal matter to help you start and run your business smoothly. Talk to us to know more, and/or check out our extensive list of services here!