How to Set Up a Company in Indonesia? Comparison of Different Legal Entities

Foreign investors are more and more attracted to the Indonesian market as this country has diverse demands, and thus create opportunities for all kinds of businesses. During the last few years, Indonesia has become one of the most important business hubs, attracting the attention of foreign entrepreneurs and enterprises.

Indonesia offers excellent opportunities to those who want to start their business in Indonesia, whether they are locals or foreigners. However, when it’s time to incorporate, many business owners find themselves in a trap, not knowing which business type suits them best.

So don’t let these options overwhelm you if you’re getting started. Let’s explore the difference, consideration points, advantages and disadvantages of each type of Indonesian business entity in this article to set up a company in Indonesia.

1. Foreign Company (PT PMA)

Also known as Perseroan Terbatas Penanaman Modal Asing in Indonesian, or foreign investment limited company, PT PMA is the most common legal establishment entity that is used by foreign investors to incorporate a foreign company in Indonesia.

So, what is a foreign company? In Indonesia, a business comprised of even 1 percent foreign national as its shareholder is legally regarded as a foreign company. Before you submit the investment application to form a PT PMA, you will need to decide your office location and business activities pertaining to the Negative Investment List (NIL) or Daftar Negatif Investasi (DNI).

Negative Investment List

Negative Investment List is issued by the BKPM (Indonesia Investment Coordinating Board). It lays out sectors that are open to foreign investments in Indonesia, as well as the maximum percentage of foreign ownership allowed based on different business classification. This has definitely set some limitations to PT PMA. The business classification in this list can range from 100 percent open to completely close to foreign investment.

This list is usually revised every three years, and the Presidential Regulation No. 44 of 2016 is the latest version. Companies that have already been incorporated earlier will not be affected by the regular change of the list.

Requirements for Setting up a PT PMA in Indonesia

Here are some requirements that you need to know in order to decide if a PT PMA is best for your incorporation strategy in Indonesia.

Shareholders of PT PMA

Indonesian Law indicates that every PT PMA requires at least two shareholders. They can be just individuals, corporate shareholders, or both. Each shareholder must hold a minimum of IDR 10 million (approximately US$750 – US$800).

In addition, PT PMA should have at least one commissioner and one director. Directors are those who reside in Indonesia and manage daily operations and activities; Commissioners supervise and monitor the said activities, and they can be non-residents. If the director happens to be a foreigner, a work permit can be applied once the company is up and running. A nominee director or a local director appointed during the work permit application process can be a good option for this scenario.

PT PMA Investment Plan

Under regulations set by BKPM, foreign companies need to have an investment plan with a minimum amount of IDR10 billion or US$750,000 for the application of each business type. So if you would like to have two businesses of different classifications established in Indonesia, you are obligated to show an investment plan of IDR 20 billion to BKPM. This high requirement is because the Indonesian government prefers to attract large-scale multinational companies, as well as look after small and medium local businesses.

Upon the successful registration of a PT PMA, depending on the category of your business license, you have to report your investment activities every three or six months.

Paid-Up Capital for PT PMA

Currently, the paid-up capital for a foreign company stands at 25 percent of the minimum capital requirement, which is IDR 2.5 million (US$190,000). Some capital-intensive industries have a higher paid-up capital.

In order to prove that you have settled the paid-up capital, you sign a capital statement letter as a statement of sufficient funds or transfer the money to your foreign company’s bank account. However, signing a capital is your only option if you do not have a bank account set up yet when your company is in the midst of incorporation.

Advantages of Incorporating a PT PMA

1. PT PMA can legally do business in Indonesia and has equal rights and responsibilities as PT (local company)

2. The Indonesian government grants better conditions for importing goods

3. Register products under the name of your foreign company

4. Allowed to sponsor business visas for clients and visitors

5. Subject to approval from the Indonesian Immigration and Manpower Department, PT PMA is able to sponsor work permits for foreign workers

6. Lower on-site import duties and tax

7. Ownership of 100% or less of the company

Disadvantages of Incorporating a PT PMA

A PT PMA doesn’t come without disadvantages as well:

1. Investment plan with a large capital requirement

2. Monthly tax reports are mandatory

3. Submission of reports for your PT PMA activities to BKPM every quarter

4. Some types of business are not allowed to PT PMA, according to the Negative Investment List

2. Local Company (PT)

While there are many options of setting up a legal entity in Indonesia, a local company, or a limited liability company (Perseroan Terbatas with acronym PT in Indonesian), is one of the most well-known company types. It is most commonly set up by local entrepreneurs in a variety of fields, and in some occasions, by foreign business owners – especially when a foreigner’s industry is included in the Negative Investment List. Local companies also have several features that separate them from other entity types.

Size of Local PT

Based on the Government Regulation No. 29 Year 2016, the minimum authorized capital to establish a PT Local has been abolished. Different size of a PT is defined based on the paid-in capital amount. They are a small local company, medium local company and large local company:

● Micro PT: IDR 0 – 50,000,000

● Small PT: above IDR 50,000,000 – 500,000,000

● Medium PT: above IDR 500,000,000 – 10,000,000,000

● Large PT: above IDR 10,000,000,000

Local Partner or Local Nominee

Technically, a minimum of two Indonesian citizens or Indonesian legal entities are the ones allowed to be the registered shareholders for a PT – 100 percent local ownership. Therefore, there is no way for a foreigner to own the PT completely – and looking for a local partner or nominee shareholder becomes the only option. The local partner or nominee holds a reasonable amount of shares, but they have no direct control of the company.

Here is a good example of the amount of share you and your local nominee can hold as a foreigner in a PT: in order to establish a distribution PT in Indonesia, 33 percent has to be assigned to a local nominee shareholder as you can only hold a maximum of 67 percent shares of the company.

The local nominee company has to be at least medium for its size, with a paid-in capital above IDR 1,100,000,000, in order to hire a foreign employee.

Advantages of Local PT in Indonesia

1. There is a clear separation between the company asset and the personal asset, and a clear responsibility between the owner and shareholders.

2. It is investor friendly, and an easy business entity to set up in Indonesia.

3. A more secure growth and viability

4. Considerably easier to obtain extra funds and capitals by issuing new shares.

5. PT is allowed to have three main business activities.

6. Through shareholder meeting, a leader can be replaced with major consensus.

7. For company’s debt, the shareholder liability is limited.

8. No business classification is restricted in Negative Investment List.

Disadvantages of Local PT in Indonesia

1. All business activities are reported to shareholders, decrease the security of trade confidentiality.

2. All dividends to shareholders are taxable.

3. The registration for incorporation takes longer time, compared to other legal business entities.

4. Local PT is 100 percent owned by Indonesian, and a foreigner needs to seek help from local shareholders through a nominee agreement.

5. A substantial amount of time and money is needed for mergers and acquisition, dissolution, and changes to articles of association of a PT. The process has to be approved by a General Meeting of Shareholders (RUPS).

3. Representative Offices

If your purpose is to only represent an overseas company in Indonesia and there is no income generated in your local activities, a representative office might be a suitable option.

BKPM recently announced a new regulation 13/2017 on January 2, 2018, pertaining to issues of investment licensing and facilities. Under the executed regulation, one new type of representative office was added – the Oil and Gas Representative Office. With the addition, there are now four types of Representative Office in Indonesia:

1. General Representative Office of a Foreign Company (KPPA)

2. Representative Office of a Foreign Trading Company (KP3A)

3. Representative Office of a Foreign Construction Service Company (BUJKA)

4. Representative Office of a Foreign Oil and Gas Company (KPPA MIGAS)

There are no exact restrictions of a KPPA MIGAS, and it is assumed that it is regulated as the same as KPPA. In this following, we will only discuss the most common types of Representative Office, KPPA and KP3A:

KPPA

KPPA is usually established in an effort to prepare for the establishment of a PT PMA in Indonesia. It also serves as a supervisor or coordinator for its affiliated or mother company abroad.

On the other hand, KPPA is not allowed to be a member of company management and generate any revenue through sales or purchase transactions and other sources in Indonesia. KPPA license is valid for three years, and it is extendable.

Advantages of KPPA

1. Full foreign ownership is allowed, easier to manage

2. Minimum expenses for a quick-and-easy setup

3. No minimum investment requirements

4. Shareholders and directors are not required

5. Speedy incorporation process

Disadvantages of KPPA

1. Any form of sales is prohibited

2. Supervisory or marketing activities are limited

3. A license can only be extended twice. Each time for a period of one year – a total of 5 years before establishing a PT PMA

4. Business activities are limited

5. Foreign worker sponsor is limited

KP3A

If you set up a KP3A in Indonesia, trading activities or sales activities are not permitted. However, you are allowed to open a branch office in any part of Indonesia, which a KPPA is not able to do.

In brief, KPPA represents any representative office in Indonesia with the objective of performing market research before establishing a PT PMA in Indonesia; KP3A serves to promote products in Indonesia as the selling agent of the mother company overseas.

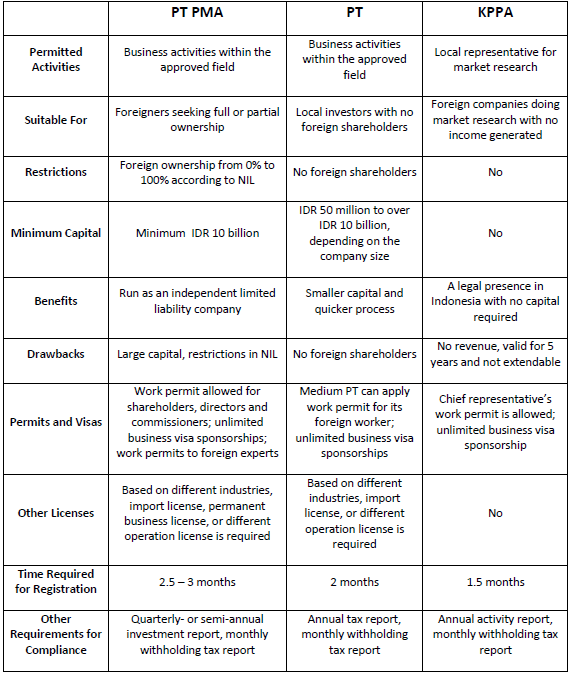

Differences between Top 3 Entities at a Glance

Conclusion

If you want more information about starting or incorporating a company in Indonesia then contact Startupr. We will help you!