Eqvista – The Cap Table Management Software Launches New Waterfall Analysis and Round Modeling Features

Starting a company and managing a cap table for an organization becomes complicated when it is not managed properly. As the cap table becomes more complex, the chances of making mistakes become common, which may affect the management of the shares of your company. That is why we would like to introduce Eqvista, a share management tool to help you track all the details of your cap table.

Eqvista is a cap table application that assists you in managing your company shares. It is a highly refined and advanced equity management software that keeps a record of all the equity-based transactions of a company.

This includes all the details of the equity types and shareholders in the company; whether they are the founders, investors or employees. This application will also assist you in issuing shares and tracking the shares all online.

To make the application better and help you handle all the future financing in your company, Eqvista has incorporated two new features. These new features will help you plan future investments into the company. The features are:

- Round Modeling

- Waterfall Analysis

Let’s understand both the features on Eqvista.

What is Round Modeling?

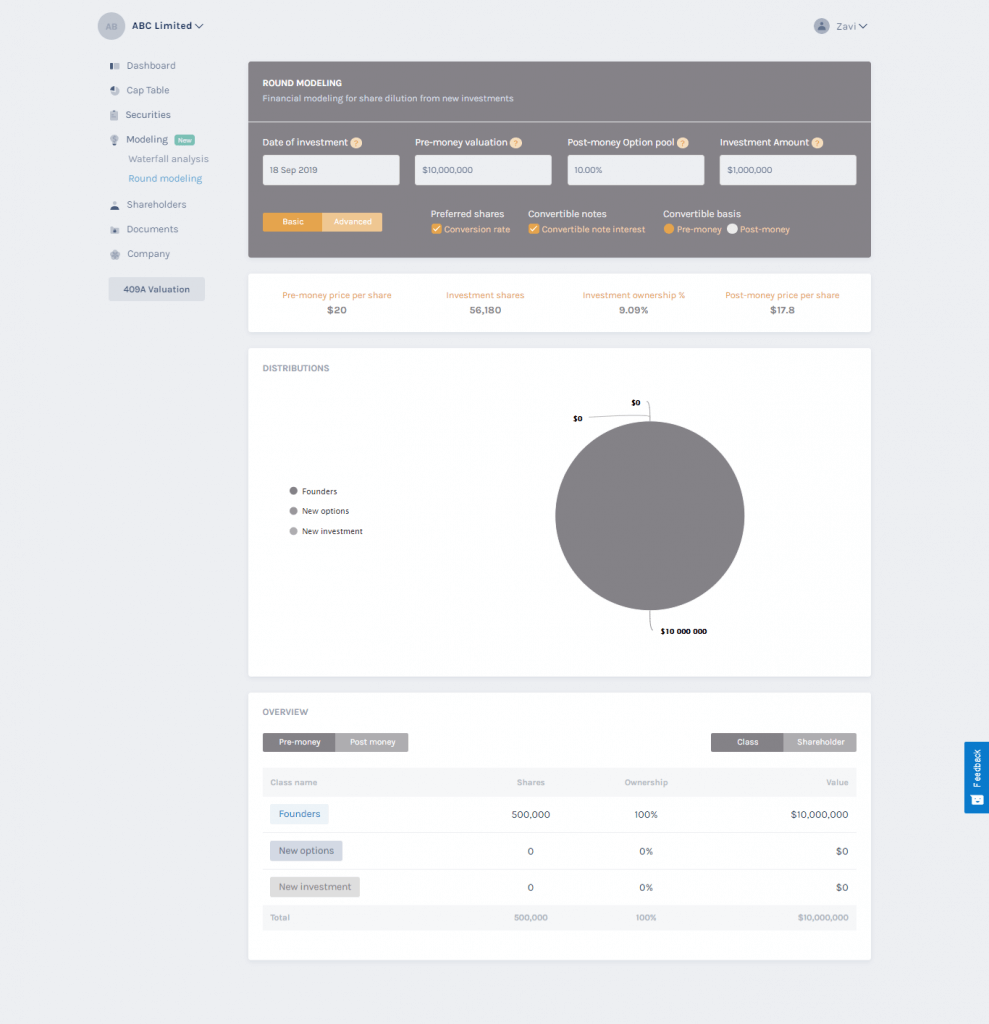

The first and foremost new feature on Eqvista is round modeling. It is a financial tool that helps investors and management of the organization to view the dilution of the cap table upon introduction of new investments into the company. This financial modeling will also consider a new ‘option pool’ for the investors or employees.

With round modeling, the company will be able to make critical decisions on the financial position of the company when receiving new investments.

It will let you know about the time and the amount of new investments by outside investors. If you want to increase the level of your business, then this financial model will help you manage the cap table and the effects of share dilution for the founders and other existing shareholders.

What are the Key Features of Eqvista Round Modelling?

The multiple features of the Eqvista Round Modelling will allow you to customize your desired financial scenario. This flexible functionality, paired with an easy to use interface, allows users to easily try numerous scenarios for their company.

The key points of the round modeling include:

- Key figures and graph charts for the new investment

- Pre-money & post-money on the convertible basis

- Multiple inputs for date of investment, pre-money & post-money valuation, and investment amount

- For preferred shares, users can opt convertible rate options

- Instantly reactivity of input data

- Convertible note interest options for convertible notes

- Pre-money & post-money convertible basis

- The basic and advanced version of new investment

Whenever you (investors or startup founders) want to test different scenarios with the multiple functionalities of the application, then this new round modeling feature of Eqvista will let you do that more effectively.

Due to all the key features, our round modeling is different and unique from other platforms. We believe our interface lets the user know the results of their round modeling more efficiently, and will also allow having the flexibility to change different factors as they like.

What is Waterfall Analysis?

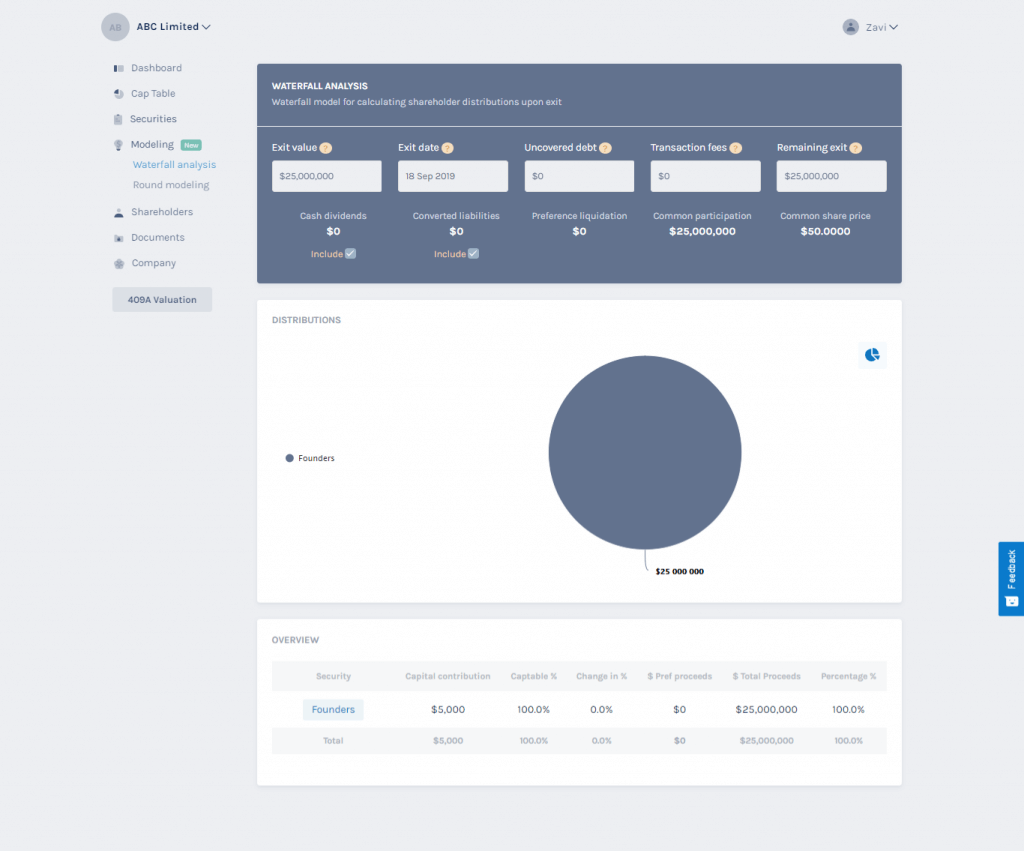

The second feature that Eqvista has incorporated in its application is Waterfall analysis. It is an analytical tool that helps in displaying the sequential breakdown of the company’s data. The waterfall analysis would display how much each shareholder receives upon the exit of the company.

This tool will not only represent the intermediate values for your company finances, but it will also let users track the data of your company in a stepwise manner. This waterfall financial modeling will also allow the users to check and calculate the total financial value of the company. This will help distribute the shares among the shareholders upon the exit of the company.

This analysis tool is not only worthwhile for the company founders, but it is highly beneficial for investors. The accuracy of the waterfall analysis depends on the calculations of the model. Generally, this model is used by the company’s investors and key management to make crucial financial decisions in a company.

So, what is the Waterfall Chart?

The waterfall chart is a perfect way to display a quick visual of the breakdown of the company’s data.

To get an idea of this from the waterfall chart, the initial and final values for the company’s finances are displayed in the columns, while the individual adjustments are depicted as floating steps.

Within the waterfall chart, users will be allowed to analyze the company’s values based on each preference round. And also how the exit values are divided between each round of investors.

The best part about the Eqvista waterfall analysis is that it will demonstrate each and every step from the starting point to the final result, along with the explanation about how you have reached there. It is also easy to read and understand. Even a beginner can understand it properly if he owns shares in the company. This is a tool that you will enjoy using, and it will help you a lot for the future of your company.

Who can use waterfall analysis?

The main stakeholders using this would be:

- Founders

- VC firms

- Angel investors

- Bank institutions

- Employees

- Directors and Company Managers

- Lawyers and Accountants

What are the Key Features of Eqvista Waterfall Analysis?

At Eqvista, the waterfall analysis modeling allows users to calculate the payouts of each shareholder by utilizing this state of the art financial model. The Waterfall analysis tool of Eqvista will not only consider the common shares and option holders in the company’s cap table, but also all the details of the preference shares as well. It will also incorporate a new and creative waterfall chart for the investors so that they can manage the finances during the preference share rounds.

The key features of our waterfall analysis include:

- Multiple inputs for exit value, exit date, and possible transactions fees

- Waterfall chart for preference rounds

- Cap Table comparison of payout values

- Instantly reactivity for efficient analysis

- Advanced calculations for preference rounds

- Cash Dividend option for preference shareholders

- Preference liquidation breakdown for preferred investors

Whenever users want to check the exit scenarios in the company’s cap table, these features of Eqvista will help them understand it properly in an easy-to-use interface. This interface was designed to be user-friendly and encompasses various functions to help founders to manage their company’s cap table. This waterfall analysis design allows users to easily view the results of the exit scenarios, as well as display all the information needed to review the payout for each shareholder.

Conclusion

We’ve covered the basic information about the new features of our twin sister company, Eqvista, namely Waterfall analysis and Round modeling. If you are facing problems in managing your company’s cap table in an excel sheet, just head over Eqvista.

With our advanced Waterfall analysis and round modeling features on the Eqvista App, you can easily calculate the financial rounds on the exit of your company. Give it a try, or contact us now for more details!