Literacy Guide to Financial Freedom in Hong Kong

Hong Kong’s economy is undergoing rapid changes. Now that the financial sector in Hong Kong is growing, more people are required to learn about money matters. Understanding the current economic conditions and market regulations enables you to follow the necessary procedures. Financial literacy is even more important because Hong Kong is a major hub for financial activity. You can gain insight into your financial situation and move toward financial freedom as a result.

Budgeting in Hong Kong is a crucial aspect of financial literacy, as it can provide you with economic freedom, security, and peace of mind. When you budget your finances wisely, you don’t have to worry about going through a financially tough phase.

If you are planning to invest or have a business in Hong Kong, this article is a panacea for you. This article outlines the steps to achieve financial freedom in Hong Kong by 2025. Unlock Hong Kong’s financial ecosystem for your benefit, empowering you with confidence to achieve financial freedom.

Simple Steps to Financial Control in Hong Kong

Achieving financial freedom is a long and arduous journey that requires discipline and effective management. It is essential to establish a solid foundation to embark on the journey to financial freedom. Several financial planning tips HK is involved in creating financial control for individuals and businesses. The steps involved in budgeting for financial independence in Hong Kong are discussed in detail below.

1. Track Your Spending

The first and foremost step to achieving financial freedom in Hong Kong is tracking your spending. In the context of personal spending, it may include expenditure on food, house, electricity, rent, etc. However, in the context of businesses, spending encompasses a range of expenses, including office rent, registration fees, electricity charges, employee compensation, equipment purchases, and other expenditures.

Having a clear understanding of spending habits allows you to spend wisely. Tracking your expenses can help you identify areas where you can save money. In this way, you can allocate your funds effectively and maximize the return on your available capital. Living in a city like Hong Kong is expensive. Therefore, tracking each dollar you are spending can help you gain control over your finances. Both individuals and businesses can use various tracking tools to monitor their expenses and determine key areas of spending.

2. Prioritize Needs Over Wants

An important step in controlling your finances is understanding the distinction between what you want and what you need. Establishing the difference between your needs and wants can significantly impact your financial freedom journey. As Hong Kong is a consumer-driven economy, people are more likely to spend on things they might not actually need. This may result in unnecessary expenditures and budget distortions.

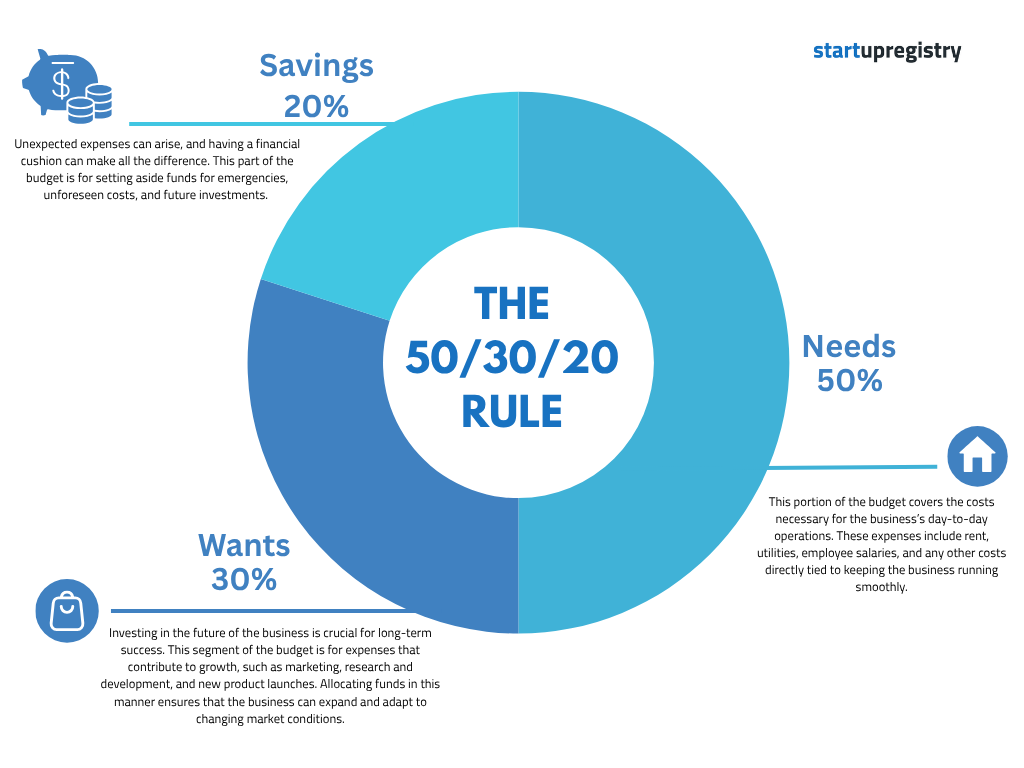

Therefore, it is essential to prioritize your needs before your wants. You are required to spend on things that are necessary for survival, such as a house, utilities, and food, rather than on discretionary spending. In this way, individuals and businesses can save a significant amount of money and make investments for further growth. They can also adopt the 50/20/30 rule for budgeting their finances. This provides a structured way to spend the money, while also allowing you to save for yourself and the business.

3. Set Realistic Limits

Budgeting involves a set of steps that need to be followed correctly to achieve financial control. One such important step is setting realistic goals. It allows you to budget and allocate your funds efficiently, making the most of your resources. Setting realistic goals is also crucial for measuring a business’s performance. It can help you determine how the business is growing and identify areas for improvement to accelerate growth.

As Hong Kong has a high cost of living, it is important to make a flexible and scalable budget. It allows you to adjust your finances in response to market fluctuations. Be sure to review your budget periodically to ensure compliance with the law and gain control over your finances. Using guides and worksheets on finances can help you prepare your own personal plans.

Leveraging Hong Kong’s Financial Ecosystem

One of the strongest and most active financial sectors globally is found in Hong Kong. People and businesses can access a variety of financial and banking services here.

Financial Planning Tips HK: The Rise of Fintech

With the introduction of fintech, the financial landscape in Hong Kong has undergone significant development. Most banks in Hong Kong are adopting various financial technologies to automate their operations, thereby saving time and money.

HK Banks Financial Freedom: Digitalization Led by HKMA

Hong Kong has numerous banks that offer a wide range of financial services, including savings accounts, investment services, and mortgage options. The Hong Kong Monetary Authority (HKMA) is promoting the adoption of fintech by banks in Hong Kong. It is encouraging them to fully digitalize their operations to provide convenience and support to customers.

Commercial Data Interchange (CDI): Streamlining Data for HK Businesses

An important introduction in the financial sector is Commercial Data Interchange (CDI). It is a key infrastructure to improve the data-sharing process between banks and data providers. This process streamlines the financial ecosystem, making the data exchange process easier.

Financial Literacy HK Businesses: Empowering Through Access

Hong Kong is home to a large, tech-savvy population. The increased use of the internet and mobile phones has given rise to several financial platforms. These platforms empower businesses and individuals to track their expenses and access their funds from anywhere at any time, significantly enhancing their financial literacy.

Importance of Reliable Bank Services for Hong Kong Businesses

Keeping a business running smoothly largely depends on reliable banking services. They support the management of the business and the business’s financial affairs. Financial freedom services from banks in Hong Kong let you make the most of your finances. You have the option of taking out a business loan, trading financing, and managing your funds at Hong Kong banks. With these solutions, companies ensure their needs are met and produce a useful budget. Using reliable banking services helps your business in Hong Kong grow and maintain stability.

Professional accounting services for Hong Kong SMEs are crucial for maintaining the financial health of both individuals and businesses. Professional accounting services providers can offer comprehensive accounting solutions to assist you with financial record-keeping and management. A large number of these providers help their clients with cash flow management, financial planning, and budgeting. Through these services, clients can comply with the rules and avoid charges or penalties.

The Path to Confidence and Freedom with Startupr

To achieve financial freedom in Hong Kong, you must demonstrate discipline and commitment. You can take control of your finances by planning your budget, making informed choices, and utilizing all the available support. Having a budget and knowledge of Hong Kong’s financial services gives you financial security. It helps you manage your finances more safely and can guide your choices. Helping your finances stand solid by regularly watching spending, sorting needs by priority, and choosing goals you can achieve. There are many banking services in Hong Kong that you can use to help you grow in your personal or professional life.

Professional accounting services support individuals and businesses in making strategic decisions and building a secure financial future. Taking control of finances can prove highly beneficial for both the business and the individual’s future. Financial education and management are key to long-term prosperity and well-being for you and your company.