Employer’s Return in Hong Kong: Guide

When operating a business in Hong Kong, employers need to constantly follow the various reporting obligations set by the IRD. The obligations extend from disclosing the company’s financial statements to the information regarding their employees in the form of an Employer’s Return. But what is an employer’s return? And how can an employer complete the filing and submit it to the IRD?

If you are struggling with these questions, this article will help to understand all there’s to know about your employer’s return in Hong Kong.

Employers Return in Hong Kong

If you are considering operating a business in Hong Kong, you have to ensure that you are filling out the Employer’s Return to the Inland Revenue Department (IRD). After all, this form is pretty necessary for every employer at the end of every assessment year.

What is an employer’s return to Hong Kong?

IR56B and BIR56A, commonly known as employer’s return form, are the reporting disclosures issued by the Hong Kong Inland Revenue Department annually to HK companies. The purpose of issuing the form is to facilitate the IRD’s assessment of the employee’s salary tax liabilities from April 1st to March 31st each year.

The IRD issues the Hong Kong Employer’s return form to companies in April to May each year. Employers would need to complete and submit the form to the government. Over 385,000 employer’s returns were filed with the IRD for the year ended 31 March 2019.

If you still find any difficulty with filing this form, contact Startupr. We will help you prepare and submit your Employer Returns and supporting documents.

Employer’s Obligations

There are some obligations for employers that need to be met to operate their business activities in Hong Kong. As an employer of a HK company, you have to meet two important obligations. The first is maintaining proper payroll records, and the second is reporting about the salaries paid to your employees.

Keeping Payroll Records

Once you start hiring new employees for your company, you have to follow all the tax obligations outlined by the IRD. As an employer, you have to maintain a record of important information about your employees. The important particulars of the employees include:

- Number of employed persons

- Personal information such as name, address, marital status, identity card, or passport number with the place of issue

- Period of employment

- Nature of employment

- The exact amount of cash remuneration given to the employees

- Non-cash and fringe benefits

- Employee and employer’s contributions to the Mandatory Provident Fund (MPF)

- Employment contract and amendments to terms of employment

It’s important to note that employers need to maintain payroll records for at least 7 years in Hong Kong, which is one of the longest periods to keep company records among jurisdictions, unlike the requirement of 6 years in the UK, 5 years in Australia, or 3 years in the US. Therefore it’s important that you keep proper storage of these records in case the IRD checks for past employment records.

If any of the information is changed, the business founder would need to inform the IRD.

Report Remuneration Paid to Employees

To report the remuneration paid to the employees, business founders need to submit the forms below to the IRD.

- BIR56A and IR56B – Employer’s Return

- IR56E form for filling out the information for every new employee

- IR56F form filled out about the employee’s termination or death

- IR56G form filled out when an employee leaves Hong Kong permanently or for a substantial period

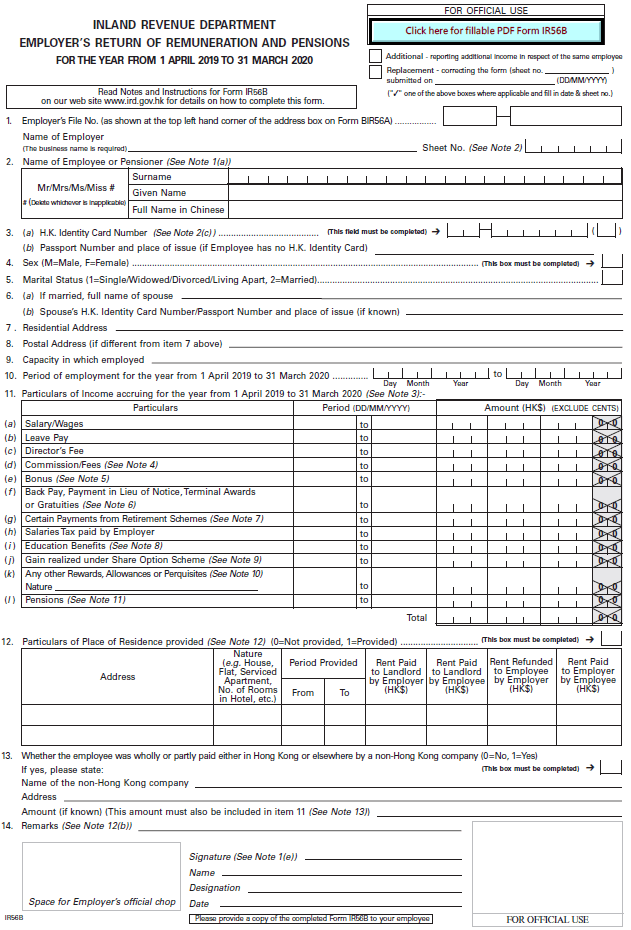

Here is a sample of the IR56B for filling out information of an employee’s annual salary:

As you can see the form includes the basic information of the employee, such as their personal details, HKID (will act as their tax id) or Passport number, postal address and marital status (to cross-verify any potential tax deductions). The form also includes the different types of personal income in part 11a-11l, and if the employee received any housing benefits (part 12).

The form also has space at the bottom for the company’s official chop (official seal).

Note: The IR56B employer’s return doesn’t include the employee’s total MPF paid, so this needs to be calculated separately to be used on their salary tax form.

How Do I Complete and Submit an Employer’s Return to My Company?

In order to complete and submit the employer’s return for a Hong Kong company, employers need to have a good understanding about the form and company obligations. Startupr notifies all our customers in advance for their employer return filing and what steps they need to take.

Our Back Office software will help you gather all the information and instructions of the IRD for your company. More importantly, employers should be aware that IR56B is not required for those employees for whom an IR56F or IR56G has already been submitted.

Prepare Payroll Information

Business founders should prepare the payroll information from April 1st to March 31st of the following year. They need to update all the personal particulars of every employee in the company. The Employer should also record the annual remuneration for every employee in accordance with the categorization of income for reporting on employer return.

Obtaining an employer’s return and notification forms

The IRD issues the Employer’s return form to Hong Kong employers on the first working day of April every calendar year. And in case an employer has lost the original forms, they can seek Startupr’s assistance to request a new copy from the IRD.

When should I complete an employer’s return?

The IRD issued the Employer’s Return form for the year in April 2020. This form is supposed to be filed within one month. If you are a newly incorporated company with no employees yet, then you can wait until next year to file your first ER form in April 2021.

Mode of Filing

According to the IRD, all HK employers need to complete the Employer’s return form to operate their business activities. The main reason for filing the form is to report the company’s information such as pensions, wages, and salaries in the relevant year of assessment to the HK government.

Startupr’s Back Office system will help you to fill up the form. Below are our fees for each document filing:

- Filing Employer’s Return, IRD $45 USD

- Resolution of Director(s)/Shareholder(s) $55 USD

Steps to submit an Employer’s Return with Startupr

If you hire a professional agency like Startupr to prepare and submit your Employer’s return with the IRD, half the work is already done. We’ll help you with all the strenuous paperwork, all the while following rules and regulations set out by the IRD – even the fine print entrepreneurs may not know of. As stated above, every entrepreneur is required to complete the employer’s return form.

There are certain steps that needs to be followed when you hire us to complete your employer’s return form

Receive email about Employers Return

When you choose us to file an employer’s return for your business in Hong Kong, we will always keep you updated on your company filings. We will notify you via email when the IRD has issued the employer’s form and what are the required documents. More importantly, you’ll be notified of the deadline about the submission of the documents to avoid penalty fees.

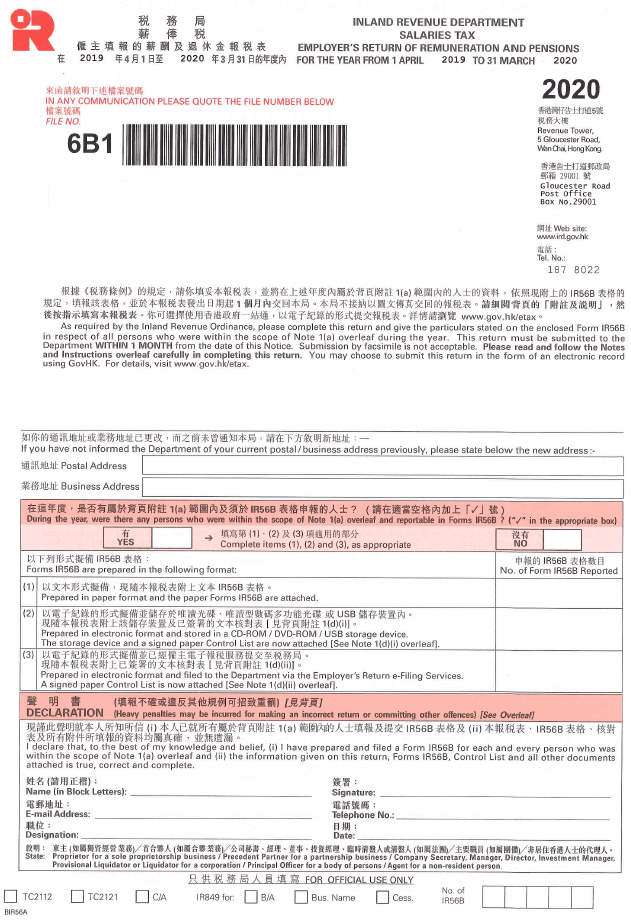

Here is a sample of the employer’s return that most Hong Kong companies receive:

Once a company receives its Hong Kong employer’s return form, it must be completed and filed with the government within 1 month. Therefore we have streamlined the process to help companies file their Employer’s Return through our Back office software.

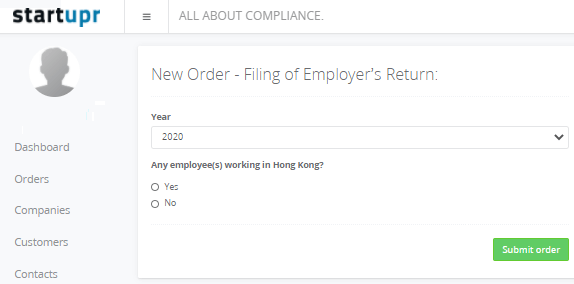

Follow link to Backoffice

We will also ask you to add your company details in our Back Office system so that we will remain updated with your business operations and background. We’ll ask you to provide the number of your employees. If you’ve hired employees for your business, then click ‘’yes’’. If no, you can file a NIL employers return all through the Back Office app.

If you have selected the ‘’yes’’ button , you must share the following information about your employees:

- Employees name

- Employee position

- HKID or passport number

- Marital Status

- Address

- Total Income for the fiscal year (including salary, fees, bonuses, remunerations, and any MPF)

Once we get the information, we will start preparing your documents and submit this to the IRD for the company.

How Do I Request for an Extension for Submitting Employer’s Return?

It doesn’t matter whether your HK company has commenced its operation, started hiring employees for the firm; you are required to complete and submit the employer return within one month from the date printed on the form.

In case an employer requires additional time to prepare your employers return in Hong Kong, they can apply for an extension with the IRD. Startupr can help you streamline the submission process by gathering and preparing all the required documents to submit to the IRD.

Penalties If I Failed to Submit Employer’s Return On Time

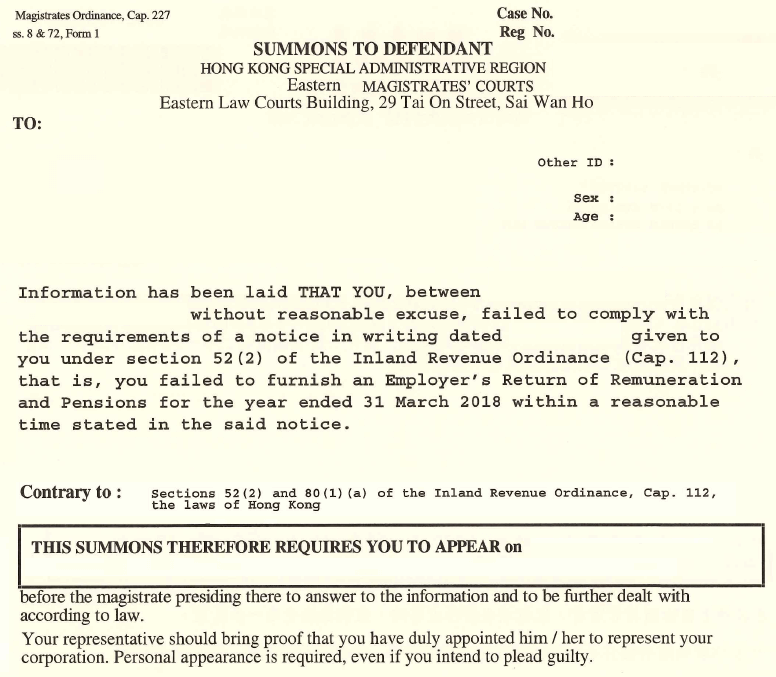

The Inland Revenue Ordinance imposes strict restrictions on Hong Kong companies if they don’t file the returns timely and accurately. Employers who fail to comply with the IRO’s reporting requirements, either by reporting inaccurate information without any reasonable excuse or failed to submit IR56B, will be subject to penalties under section 80(1) of the IRO, usually including late penalties after the 1 month deadline.

In cases where the ER form is way overdue, the Hong Kong government has the power to issue a court summon for a failure to file a company’s Employer’s Return.

Here is a sample of a court summon notice:

That’s why it’s best to be on top of your employer’s return filing in Hong Kong, and be sure to contact Startupr in case you need any assistance.

Conclusion

This article is all about filing and completing the employer’s return form in Hong Kong. After all, to operate a business in Hong Kong, employers need to abide by the reporting obligations set by the IRD.

This guide will help you manage your employer tax filing obligations in Hong Kong, such as managing and submitting different types of forms with the IRD. Here, Startupr can help you. Our experienced team will help you file your employer’s return with the IRD. For more information, contact us today!