Hong Kong Corporate Income Tax (CIT)

Hong Kong is renowned for its low and simple tax regime and the world’s most business-friendly jurisdiction. This simple tax system, with low personal and corporate tax rates, has allowed Hong Kong to emerge as one of the preferred locations for global enterprises across Asia. If you have decided to set up your business, then you should be aware of the Hong Kong taxation system.

Hong Kong charges a corporate income tax of 16.5% on the assessable profit earned by companies within the territory. If your company derives profits from operations in a trade, profession or business in Hong Kong, then you would be liable to pay Hong Kong Corporate income tax.

In this article we cover the important aspects of the Hong Kong Corporate Income Tax, or CIT, and what is crucial to know for establishing your business in Hong Kong.

Hong Kong Corporate Tax or Profits Tax

Every incorporated company generating profits for carrying on a trade, business, or profession is liable to pay profits taxes in Hong Kong.

However profits derived from external sources, i.e., offshore profits, are considered beyond the territorial scope of Hong Kong’s taxation system. This offshore profit also includes the profit derived by locally incorporated companies.

The different classifications and tiers set by the IRD for business owners would determine the amount of corporate taxes to pay for your business operations.

What is corporate tax or profits tax in Hong Kong?

There is an assessable profits tax rate of 16.5% for the company’s derived profits in Hong Kong. This corporate tax rate falls to 8.25% for profits under HKD 2 million. This is considered as one of the lowest corporate tax rates as compared to other economic giant powerhouses, for instance South Korea at 22% corporate tax rate and Japan at 31%.

What’s more, companies are not obliged to pay capital gains tax on the profit earned from the sale of property, stocks, bonds, and other assets. There are no sales taxes or value-added taxes, no withholding tax on dividends and no interest imposed on companies. It means that the dividends earned from local companies are exempted.

Who is liable to pay a profits tax in Hong Kong?

Following the Inland Revenue Ordinance (IRO), Hong Kong Profits taxes are paid only on certain conditions. Below are the conditions set by the Hong Kong government:

- When a person is operating a trading company, profession or business in Hong Kong;

- When the profits are arisen or derived from Hong Kong; and

- When the trade, business or professions derives profits

Remember that Hong Kong follows a territorial source of principle regarding the profit earned by the companies. To put it in simple words, registered Hong Kong companies will have to pay the taxes on the profit earned within Hong Kong, and can apply for the exemption of offshore profits.

Flat Corporate Tax Rate in Hong Kong

Corporations in Hong Kong have two CIT rates applicable to profits, deemed the two-tiered profits tax regime, being at 16.5% and 8.25%. This tax regime came into effect from the year of assessment 2018/19 through the IRO. Both corporations and unincorporated businesses will come under the two-tiered profits tax regime.

Here are the applicable tax rates that you should be aware of:

Single tier corporate tax system

According to the single-tier corporate tax systems, incorporated and unincorporated businesses need to pay the tax rate of 16.5% and 15% respectively on their assessable earned profit in Hong Kong.

Two-Tier Profits Tax Regime

The two-tier profits tax regime applies to both unincorporated and incorporated corporations. This was introduced by the IRO to significantly reduce the tax burden of most small and medium-sized enterprises (SMEs), as:

- For unincorporated businesses, the first half of the profit earned up to HK$2 million will be taxed at 7.5%, and the surplus will be charged at the 15% tax rate.

- For corporations, the first half of the derived profit up to HK $2 million will be charged at 8.25%, and the remaining profits will continue to be taxed at the existing 16.5% tax rate.

Tax Deductions and Allowances

Deductions are the incurred outgoings and expenses by the organization to generate profits from business operations in Hong Kong. The HK government allows for many types of deductions to be claimed for most companies doing business in the city.

What are the tax deductions and allowances available?

There are numerous tax deductions that can be claimed under the prescribed conditions. Here are the major deductions that will affect your tax bill:

Expenditure on Building Refurbishment

If you are thinking about renovating or refurbishing your business premises, you can claim the tax deduction for expenses on building refurbishments. When a company incurs capital expenditure on the renovation of business premises, they are allowed to deduct that expenses over five years in equal installments starting from the year of expenditure.

Expenditure on machinery and plants linked to manufacturing, and on computer hardware and software

For this type of business expenses, the company is allowed a full deduction from the commencing period when the expenditure was incurred.

Depreciation Allowances

Business firms can claim for depreciation allowances under certain conditions which are as:

- Commercial Buildings Allowances: It will be chargeable on the commercial buildings and structures. The annual allowance will be charged at 4% on the cost of the premises’ construction, and the surplus allowance will be due until the disposal of the premises.

- Plant and Machinery: For plant and machinery, the initial allowance is set at 60% on the cost. The Board of Inland Revenue prescribes the annual allowance in their rules on reducing the asset’s value at rates of 10%, 20%, or 30%. The items which incur under the same rate of annual allowance are grouped under one “pool”. The balancing allowance is assessable only on business cessation when there is no successor.

- Industrial Buildings Allowances: Industrial buildings and structures can be claimed under the industrial buildings allowance. The initial allowance in this sector is 20% on the cost of construction of the premises, however the annual allowance is 4% on the cost thereafter. And the balancing allowance or charge will be due upon disposal of the premises.

Tax Reduction Allowances

After reducing your assessable profits from the various business deductions, this amount is further reduced by a tax allowance, normally up to HKD 20,000. The tax reductions are as:

| Year of Assessment | % of Tax Reduction | Maximum per case |

| 2014/15 to 2016/17 | 75% | $20,000 |

| 2017/18 | 75% | $30,000 |

| 2018/19 | 100% | $20,000 |

| 2019/20 | 100% | $20,000 |

The tax reduction allowances (as per the IRD tax tables), for each company is the total reduction of corporate income tax a Hong Kong company can enjoy for each year.

Thus for example, after taking all the tax reductions throughout the year, if a company has a tax bill of $20,000 or less in the year 2019/20, then 100% of this would be reduced, and the company would not have to pay any corporate taxes.

Hong Kong Corporate Income Tax Figures by the IRD (2018/19)

Each year the IRD releases an Annual Report about the tax figures for Hong Kong, outlining the statistics for each major tax category, namely profits tax, salaries tax, property tax and other tax related information.

Profits Tax Assessed

The IRD department of Hong Kong attains their revenue through the fees, taxes, and the duties paid by the taxpayers concerning the relevant legislation. The profits tax is typically assessed by using references of the profits of the taxpayers by looking at the previous years figure.

Below is a graph specifying the profits tax assessed by the IRD from 2015 to 2019 from all incorporated and unincorporated companies in Hong Kong.

This graph reflects a notable growth in the economy of Hong Kong from 2017, as well as in the amount of assessable profits in various business sectors. In 2018-19, the profit assessed amount approaches $173.6 billion, a significant increase of $28.7 billion (19.8%) as compared to 2017-18. The profit assessed by the unincorporated businesses increased as well, from $5 billion in 2015/16 to $6.4 billion in 2018/19.

Ratio’s of the corporation profits tax assessed under 2017-18 by the business sectors:

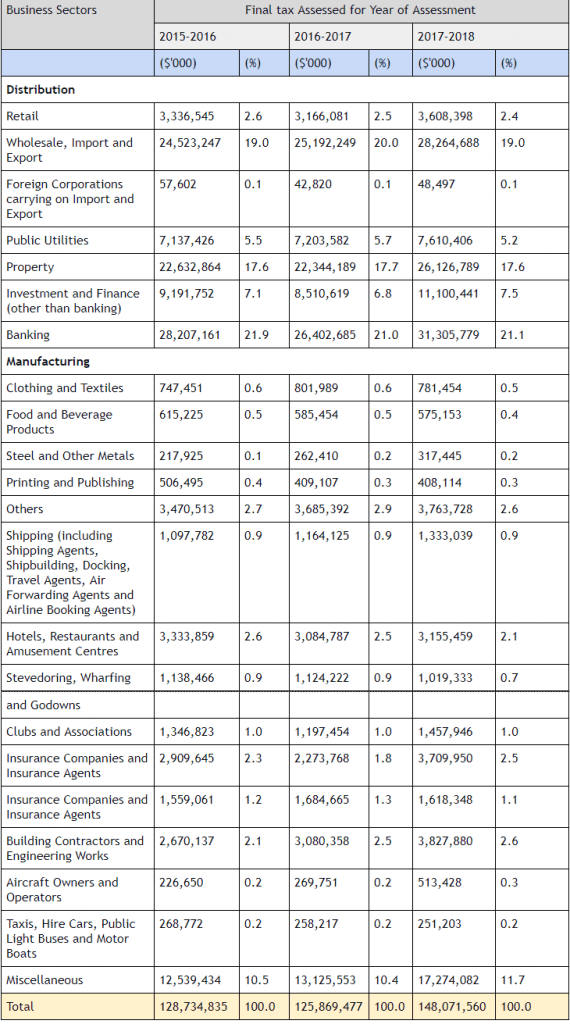

The IRD also tracks the corporate income tax figures by business sectors for each year. The amounts of final tax assessed in respect of different business sectors are described in the table below.

For the year 2017-18, the total final tax assessed for the banking, financial and property sectors together contributed 46.2%, while the distribution sector derived the profits tax of 21.5%. This graph can show you the major business industries in Hong Kong, being distribution, banking, investment & finance and property, and how the government derives tax from each sector.

The IRD also provides a more detailed analysis of these corporate tax figures, as outlined in the next section.

Corporations’ Profits Tax Contributions from Various Business sectors:

From this breakdown of the corporate taxes assessed from 2015/16 to 2017/18, you can see the trends of the amount of tax paid various over the years. While some industries remained fairly stable, as in Wholesale, Import and Export at 19-20% and Property at 17.6-17.7%, investment and finance increased from 7.1 to 7.5% while Hotels, Restaurants and Amusement Centres declined from 2.6% to 2.1%. You can view the graph in more detail to learn more about how the IRD derives its tax from the different sectors.

Filing Corporate Tax in Hong Kong

Hong Kong follows the fiscal year commencing from April, as compared to other economic regions whose tax year usually runs from January to December.

The fiscal year in Hong Kong ends on March 31st, so the profits tax returns should be taxed in the same tax year. Therefore the 2020(2019/20) PTR will be for the period from April 1st, 2019, until March 31st 2020. However, there is a provision in Hong Kong regulations that companies can choose their financial year as per their requirements. That period should fall under a certain fiscal year-end as per Hong Kong.

For example, a company selecting the fiscal year ending on December 31st, 2020, would file their financial statements on the 2021 PTR.

Requirements and due for filing a profits tax return (PTR) in Hong Kong

The IRD will grant one month to companies from the issuing date of PTR to file the accounts. However, companies can claim to extend their PTR filing up to 9 months after their financial year-end, starting from their second PTR filing.

And if you are setting up a business for the first time, the HK Inland Revenue Department issues the first PTR 18 months after the incorporation date. In this case, the PTR needs to be filed and submitted within the three months of the issued date. If somehow companies fail to file the PTR, they are obliged to pay a late penalty fee or face stricter penalties for non-compliance of PTR filings by the IRD.

For example, a company incorporated in Hong Kong on October 31st, 2019 would receive their first PTR around 18 months after incorporation, so around March 31st, 2021. The company would then chose its financial year end (in this case normally December 31st, 2020 or March 31st, 2021), and would need to file their accounts over the last 18 months on or before June 30th, 2021 (3 months after the issue date)

Documents submitted to the IRD

There are some documents that need to be filed for the annual set of returns:

- Issued PTR form from the IRD.

- A certified copy of the statement of Profit and Loss, balance sheet, Audit report in respect of the basis period,

- A tax computation determining how the amount of assessable profits(or adjusted loss) has been arrived at

Note: Remember that these documents normally need to be completed by a Hong Kong Certified Public Accountant. They will be responsible for checking and reviewing the company accounts and generating an audit report and tax computation for the company. These CPAs will be designed as the tax representative and be accountable for completing the PTR and tax calculations for the company on their assessable profits.

Auditing in Hong Kong

Regardless of the company size and stage, every company needs to complete the auditing to operate the business effectively. Though this area of the company doesn’t excite most business owners, it is something that needs to be considered from the start of the company operations.

Requirements of Audited financial statement in Hong Kong

Every incorporated company in Hong Kong needs to provide their financial statements to the auditors to show the overall business operations. A balance sheet, income statement, and general ledger of the business transactions are included in the business firms’ financial statements. It will be the responsibility of the auditors to review all these statements, along with the supporting documents and the accounts.

In Hong Kong, the auditor will review all the company’s accounts and prepare all the documents needed for the company tax filing. In case the IRD requests any further information from the company, normally in cases of offshore tax exemption, the auditor would also assist for these requests.

Here are some documents that need to be given to the auditors, so that a CPA can conduct the audit efficiently:

- All bank statements

- All merchant account statement

- All sales invoices/ consulting service invoices/ contracts

- All purchases invoice/subcontractor’s invoices

- All financial statements/management accounts

- All expense receipts

- All other relevant accounting documents

The reason behind gathering all the documents by the CPA is not only to have the financial information, but also to understand the internal system and organization of the company operations for writing the audit report.

Filings of PTR through audit firm

As soon the CPA receives all the required company documents, they can commence the audit and send the completed audit report and tax computation to the IRD.

When the IRD receives the documents, they will check the figures and the tax payable schedule to check the company operations. This procedure can take up to a few months, as the IRD may be busy with other tax filings, especially around April, August, and November.

When the first initial audit has been submitted to the IRD, the CPA will advise about preparing the next year’s audit. It is always advisable to prepare these documents ahead of time, as companies only get one month to prepare the audit reports and tax filings right after receiving the subsequent PTRs from the IRD. As this may not be enough time to conduct an audit of a full year’s worth of transactions, it’s always suggested to do your company audit ahead of time.

How can Startupr Help You?

This article has provided all the important information regarding the Hong Kong corporate Income tax (CIT), profits tax return (PTR), IRD’s tax figures and how to file corporate taxes and get your auditing conducted in Hong Kong. Taxes are one of the most challenging areas of operating a business, but if you are aware of all the procedures, deadlines, and documentation, you can overcome this procedure much easier.

Startupr assists companies in preparing the documents and tax filing responsibilities in Hong Kong. We also provide comprehensive services at a fair price, by appointing an independent CPA in dealing with your company’s audit and tax filings. Feel free to contact us for a free quote, tax information or tax status for your company.